Retirement Investment Planning in Stourbridge: Expert Advice for a Secure Future

Retirement investment planning is one of the most important financial tasks you’ll make in your lifetime, and if you’re based in Stourbridge, you have access to local expertise that can help guide you every step of the way. At KGJ Insurance and Financial Advisers, we’ve been helping individuals and families in the West Midlands secure their futures for over 50 years. Whether you’re just starting to think about retirement or are looking to optimise your existing plans, this guide will walk you through the essentials of retirement investment planning in Stourbridge.

Why Retirement Investment Planning Matters

Retirement isn’t just about stopping work, it’s about maintaining your lifestyle, achieving your goals, and having the financial freedom to enjoy your later years. With increasing life expectancy and rising living costs, Planning early and effectively has never been more important.

Understanding Your Retirement Needs

The first step in retirement investment planning is determining your life goals. This depends on factors like:

- When do you want to retire?

- Your living expenses

- Your healthcare needs

- Your travel and leisure plans

- Whether you plan to relocate or downsize.

In Stourbridge and surrounding areas, the cost of living can vary, so it’s important to tailor your plan to local realities while also considering broader economic factors such as inflation and interest rates.

Key Investment Options for Retirement

There’s no one-size-fits-all solution, but here are a few options that often form part of a feasible retirement plan:

1. Pensions

Pensions remain the cornerstone of retirement planning in the UK. Workplace pensions and personal pensions both offer tax-efficient ways to save. The earlier you start contributing, the more time your money has to grow.

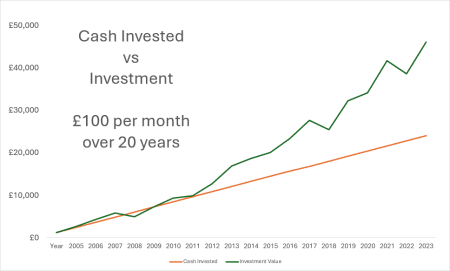

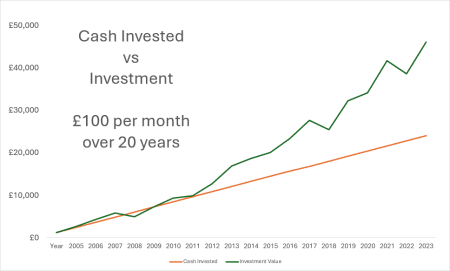

The graph shows the impact of an invested pension. The growth shown is based on a mixture of world stock markets. Every investment is different, this is for illustration only.

2. ISAs (Individual Savings Accounts)

ISAs offer flexibility and tax-free returns, making them an excellent complement to a pension. Stocks & Shares ISAs can provide growth over the long term.

3. Other Investments

Depending on your risk appetite, investments in more complex funds can offer the potential for higher returns. However, they also come with risk, so professional advice is crucial.

Local Insight Matters

Choosing a financial adviser who understands the local economy can make a significant difference. At KGJ, our advisers live and work in the region. We understand the nuances of retirement investment planning specific to Stourbridge and can provide tailored strategies that work for your individual circumstances.

When Should You Start?

The simple answer: as soon as possible. The earlier you begin planning and investing, the greater your potential returns through compounding. However, it’s never too late to take control of your retirement planning. Even in your 50s or 60s, there are effective strategies we can implement to improve your outcomes.

If you are in your 20’s or 30’s, maybe getting established in your career, then it’s important you understand that you can do so much now to build better options for your future than at any time. See how even modest investments can make a big difference:

How KGJ Can Help

At KGJ, we pride ourselves on delivering independent, bespoke financial advice to clients in Stourbridge and beyond. Our retirement planning services include:

- Pension reviews and consolidation

- Investment portfolio construction

- Tax-efficient savings strategies

- Estate and inheritance planning

We’re here to help you build a retirement plan that reflects your goals, values, and financial circumstances.

Retirement investment planning doesn’t need to be overwhelming, especially when you have a trusted, local adviser on your side. Whether you’re looking to grow your pension pot, explore new investment options, or simply gain peace of mind about your financial future, KGJ Insurance and Financial Advisers are here to help. Our experienced team specialises in Retirement Investment Planning in Stourbridge and is ready to create a tailored strategy that works for you.

Contact us today for a free, no-obligation consultation. Call us on 01384 390909 to speak with one of our advisers. Let’s start planning the retirement you deserve.

Related news

The 2025 Budget

Weathering the Winter Costs: 5 Ways to Protect Your Home and Finances

Plan, don’t panic! 5 Financial Tips for the Festive Season

UK Budget 2025: What Investors Need to Know

Land Rover Insurance in Stourbridge: Insuring Vehicles Over £75,000

Stop the Double Taxation of Pensions: Protect Pension Funds & Death Benefits before 2027

2025 Car Insurance Renewals: Why Now Might Be the Perfect Time to Review Yours

Why Investing Is Better Than Just Saving: A £10,000 Example

4 Ways Mortgage Advisers in Stourbridge Are Helping Locals Navigate 2025’s Property Market

4 Reasons to Consider Private Medical Insurance