The Stamp Duty Deadline on 31st March is Fast Approaching

Are you aware of the upcoming Stamp Duty Land Tax (SDLT) deadline on 31st March, 2025? If you are planning to buy property in England or Northern Ireland in the future, you need to understand how this deadline could affect your finances.

What is Stamp Duty Land Tax?

Stamp Duty Land Tax (SDLT) is a tax you must pay when purchasing property or land over a certain value in England and Northern Ireland.

The amount you pay depends on whether the property is residential, non-residential, or mixed-use, as well as your eligibility for reliefs or exemptions, such as first-time buyer status, purchasing an additional property, or non-UK residency. You can view the details on the HMRC website.

What Are the Changes?

In September 2022, the Government temporarily increased the 0% SDLT threshold for residential properties from £125,000 to £250,000 to support the housing market. However, this measure ends on March 31, 2025, with the threshold reverting to £125,000 on April 1, 2025.

This means that buyers who complete their purchase after 31st March, 2025, could face significantly higher Stamp Duty Land Tax costs.

How Much Will You Pay?

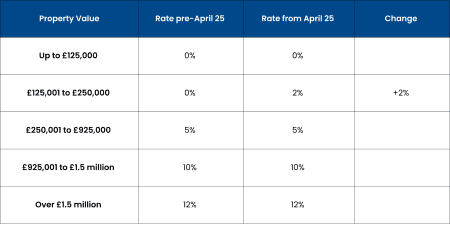

Here’s how the SDLT rates compare before and after the deadline:

Examples

Example 1: Buying a £100,000 Property

- Before April 1, 2025: £0 SDLT

- After April 1, 2025: No change – still £0

Example 2: Buying a £175,000 Property

- Before April 1, 2025: £0 SDLT

- After April 1, 2025: SDLT now at 2% = £3,500

Example 3: Buying a £250,000 Property

- Before April 1, 2025: £0 SDLT

- After April 1, 2025: SDLT now at 5% = £12,500

Example 2: Buying a £950,000 Property

- Before April 1, 2025: SDLT at 10% over £925,000 = £95,000

- After April 1, 2025: No change, SDLT still £95,000

(If the purchase is for an additional property there is an extra 5% surcharge on top of the above rates.)

First-Time Buyers: What You Need to Know

The temporary increase in First-Time Buyers’ Relief also ends on March 31, 2025. This means:

- The nil-rate threshold reverts from £425,000 to £300,000.

- The maximum property value eligible for relief drops from £625,000 to £500,000.

Key Considerations

- Timely Completion: SDLT is determined by your completion date, not your purchase agreement. If you buy before 31st March, 2025, but complete after this date, the higher rates will apply.

- Market Demand: As the deadline approaches, solicitors, lenders, and removal companies may experience delays.

- Mortgage and Cost Considerations: With the cost-of-living crisis and rising mortgage rates, saving thousands in SDLT could make a significant financial difference.

- Working with solicitors: It is worth talking through the conveyancing timeline with your solicitor and as everyone races to complete before the deadline it is important to keep in regular touch with your conveyancer.

Expert Advice

SDLT rules can be complex, and it’s a good idea to seek advice tailored to your situation. At KGJ, our financial advisers can explore your situation and offer guidance.

At KGJ, we’re dedicated to helping you navigate the complexities of tax, ensuring you’re making the most of every opportunity for growth and security. Our experts are here to guide you every step of the way when you’re looking at the financial side of purchasing a property, from mortgages to tax planning. Take control of your financial future and get in touch with KGJ today by calling 01384 390909, emailing enquiries@kgjinsurance.com or through our contact form.

Related news

UK Budget 2025: What Investors Need to Know

Land Rover Insurance in Stourbridge: Insuring Vehicles Over £75,000

Stop the Double Taxation of Pensions: Protect Pension Funds & Death Benefits before 2027

2025 Car Insurance Renewals: Why Now Might Be the Perfect Time to Review Yours

Why Investing Is Better Than Just Saving: A £10,000 Example

4 Ways Mortgage Advisers in Stourbridge Are Helping Locals Navigate 2025’s Property Market

4 Reasons to Consider Private Medical Insurance

A Smart Investment – Why Business Health Insurance Makes Sense

4 Mistakes to Avoid | Mortgage Advice from Stourbridge’s Trusted Advisers

Retirement Investment Planning in Stourbridge: Expert Advice for a Secure Future